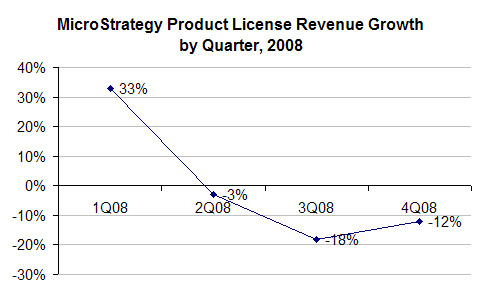

MicroStrategy announced their 4Q 2008 results yesterday. The stock price rose, since the company beat analyst estimates, but as InformationWeek reports, the most interesting news is that product license revenue dropped 12% over the 4th quarter 2007.

Industry observers and investors are watching keenly for any signs of whether BI vendor consolidation is making it harder for the remaining independent BI vendors like MicroStrategy, and license revenue growth is considered a key indicator of long-term competitiveness.

So are the latest figures an indication that the independent BI vendors are in trouble? One complicating factor is that MicroStrategy’s customers may have been waiting for release 9, which is due to be launched this quarter.

From the chart below, it looks like both factors may be in play. There was a steep drop in license revenue growth over the first half of the year, which may be attributable to industry consolidation, but the latest results show an improvement in 4Q (or rather, a slower rate of decline).

What does MicroStrategy think? They don’t appear to be saying — the press releases from 1Q and 2Q included quotes from Arthur Locke (CFO) and Michael Saylor (Founder), but nothing since, and unlike other vendors in the industry, MicroStrategy doesn’t host financial analyst calls to discuss the results.

Business intelligence is still a growing market, so there’s room for lots of players. My guess* (and that’s all anybody can really do) is that the independents will survive, and maybe even grow this year, but that the BI megavendors will be increasing their market share.

________________________________________

* Just to be sure, in this litigious age: this is my personal guess, not any form of advice, professional or otherwise, and I make no guarantees that anything in this (or any other!) blog posting is correct, including the numbers in the chart above. Caveat Emptor!.

Comments

One response to “MicroStrategy: The Start of the End? or Just a New Product Cycle?”

I would guess 50-50 between economic environment cutting expenditure and megavendor competitors taking away new market share. In the IBM 2008 Q4 analyst call CFO Mark Loughbridge said “Information Management grew organically and Cognos also had a terrific fourth quarter” – IBM Information Management software grew 18% and I think that’s where IBM lumped in the Cognos numbers. The IBM software pillars don’t match up well to the acquired BI and DI software.

Anecdotally I’ve heard Cognos is one of the only divisions in IBM that does no have a hiring freeze on.