On February 17, 2009, President Obama signed into law the American Recovery and Reinvestment Act of 2009 (ARRA or the Recovery Act). It places great emphasis on accountability and transparency in the use of taxpayer dollars — anybody that receives funds must meet stringent legal requirements to publish timely and accurate accounting, allocation and results data for every dollar received:

Recipient Reports. Not later than 10 days after the end of each calendar quarter, each recipient that received recovery funds from a Federal agency shall submit a report to that agency that contains–

(1) the total amount of recovery funds received from that agency;

(2) the amount of recovery funds received that were expended or obligated to projects or activities; and

(3) a detailed list of all projects or activities for which recovery funds were expended or obligated, including

- the name of the project or activity;

- a description of the project or activity;

- an evaluation of the completion status of the project or activity;

- an estimate of the number of jobs created and the number of jobs retained by the project or activity; and

- for infrastructure investments made by State and local governments, the purpose, total cost, and rationale of the agency for funding the infrastructure investment with funds made available under this Act, and name of the person to contact at the agency if there are concerns with the infrastructure investment.

(4) Detailed information on any subcontracts or subgrants awarded by the recipient to include the data elements required to comply with the Federal Funding Accountability and Transparency Act of 2006 (Public Law 109-282), allowing aggregate reporting on awards below $25,000 or to individuals, as prescribed by the Director of the Office of Management and Budget.

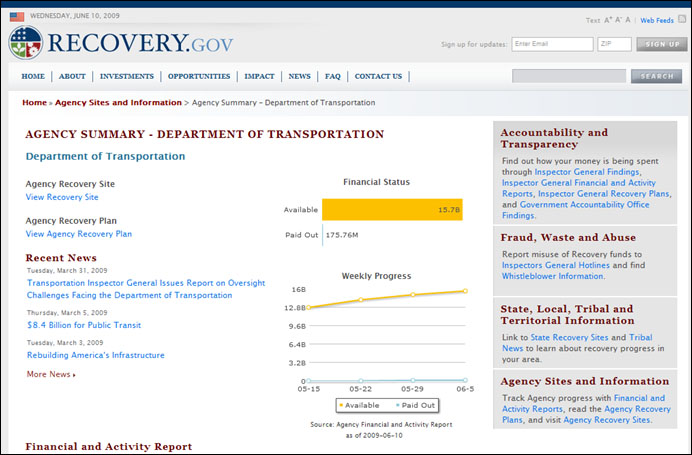

The US government has then promised to publish much of this information on the www.recovery.gov website:

“Recovery.gov is a website that allows you, the taxpayer, to see how the money from the American Recovery and Reinvestment Act is being distributed and managed. Within days after the signing of the legislation, Federal agencies started distributing funds. As the agencies report data to Recovery.gov, you will be able to see the states, Congressional districts, and even Federal contractors that receive Recovery fund. We’ll display that information visually, through maps, charts, and graphics.”

This means the US government is essentially mandating effective use of business intelligence for any organization that touches the US$787 billion in economic stimulus money, and major vendors such as SAP and IBM have quickly rolled out reporting packages to help organizations meet the new requirements.

SAP has published a white paper with more information about Maximizing the Value of Economic Stimulus Funds

And SAP has recently announced a Management and Reporting of American Recovery and Reinvestment (ARRA) funds package. It is designed to help organization answer questions such as:

- How do I meet reporting requirements and deadlines?

- How do I effectively monitor and account for spending of funds in mandated time frames?

- How do I enable complete visibility into spend?

- How do I measure and report outcomes and performance?

- How do I mitigate risk and ensure compliance with federal requirements?

The package is based on the SAP BusinessObjects portfolio, including dashboards:

Of course, dashboards are useless without the underlying data, and so the ARRA reporting solution includes information management to provide analytical support and models for reporting stimulus data:

The solution also includes options for strategy management to enable government policy management and tracking of stimulus spending against strategic policy outcomes, and mobile software to provide remote access to business intelligence data:

Choosing a flexible solution will be essential: Chris Kanaracus of IT World reports that the federal government may still fine-tune its reporting guidelines leading up to the first quarterly report deadline of Oct. 10.

And collecting the data from the recipients is just the start. The Recovery Act proposes a sophisticated “Accountability Framework” designed to monitor reporting compliance, operational efficiency, and when the strategic outcomes are actually being achieved (see diagram below).

As I’ve mentioned before on this blog, it’s pointless to talk about performance without risk, so it’s especially gratifying to see that the accountability framework emphasizes the importance of governance, risk, and compliance:

To promote effective management of Recovery Act funds and compliance with the objectives of the Act, the Department developed a Risk Management Plan that includes the following:

- Identification of significant risks related to the achievement of Recovery Act goals and the primary drivers of such risks (at the Department level and program-specific level)

- Quantification of the potential impact and likelihood of significant risks

- Evaluation of existing control activities

- Review of performance monitoring and reporting processes

- Analysis of significant internal control gaps and areas for improvement

- Mitigation of risks with the highest probability of occurrence and greatest impact if not mitigated

- Tracking of progress against the risk identification, assessment, and mitigation framework.

I can’t sum things up better than Doug Henschen in his article on Tracking the Stimulus: BI Answers Call for Government Transparency:

“The Recovery Act sets forth audacious goals, including creating 3.5 million jobs, upgrading 75 percent of the nation’s worst bridges and highways, and weatherizing and modernizing 75 percent of federal buildings to be more energy efficient — all within two years. Add to that list the goal of attempting what may turn out to be the biggest experiment in e-government-style reporting and transparency every attempted. What’s more, it’s a BI-powered project, and within a few short years it may prove whether (or not) there is such a thing as intelligent government.”

Greater government transparency through business intelligence may turn out to be the most challenging – and world-transforming — BI applications ever.

Other Links

Comments

6 responses to “American Recovery Act Business Intelligence”

Timo,

Thank you much for posting this information. As a professional services firm, we are seeing an increased number of requests from our clients with experience in implementing SAP/BO Reporting for ARRA.

As you can imagine, identifying individuals with this type of background is beyond challenging. Would you or any of the group have any recommendations?

Regards,

Tom Anderson

New Directions

tanderson@gonewdirections.com

[…] BI Questions Blog lays out the SAP application, showing screen grabs of the data required, how it’s reported and so much more. There really will be transparency in the spending of the stimulus funds. Pretty darn cool. […]

Another unrleated comment from me! I was reading this comparison between Microstratgey 9 and BusinessObjects XI 3.1 by Microstratgey.

http://www.microstrategy.com/quicktours/businessobjects/index.asp

I understand this article will not talk about the strengths of BusinessObjects. But few things that I wish BusinessObjects can bring in are

– The consistency across the different reporting panels for webintelligence

– Reusable components for webintelligence. Like data provider reuse or report reuse.

– Consolidate the number of information delivery tools to two or three.

– The long term wish would be to have one information delivery tool which could be catered to all types of information delivery needs. Like the application should be able to adapt and metamorph it’s interface based on the user 🙂

Nice post Timo. I’m not sure if the federal government is effectively mandating the use of Business Intelligence, but I hope to find out very soon……The Aberdeen Group just launched a research survey to understand how government departments and agencies perceive the monitoring and reporting requirements related to ARRA – and what they are doing to meet those requirements – which are looming large on the radar now. Anyone in government who would like to take part can find the survey here: http://www.aberdeen.com/survey/ARRA_compliance/

Thanks,

David.

Hello Tim,

Seeing the terms “American Recovery Act” & “Business Intelligence” might not help the Business Intelligence industry.

On this side of the pond, the question being asked is:

“How much worse off are the insurance, banking and automotive industry sectors because AIG, Citibank and GM did not go bankrupt?” Certainly industry structure, market share and pricing would have improved for ALL remaining competitors with the elimination of a weak competitor.

(Tim, I greatly enjoy your blog. This topic is a hot one because America, a.k.a. USA Inc., is now in over 170 lines of business according to our analysis at eCompetitors.com – and, in my opinion, business intelligence is not a term often associated with how our government runs anything; and any BI reporting system that implies otherwise will be unfairly criticized because the data used will certainly be suspect. Thanks again for your great posts, Alan

Hi Tim,

This is really cool. SAP bringing transparency into where all that money is going. As the US is not the only country doing having stimulus packages, I am convinced this will help throughout the world.

I love that we are on top of this opportunity.

By the way is that you in the white paper? 😉

Great post, Mark.